Imagine you receive a large, tasty-looking chocolate-chip cookie as a gift. Giddy, you place it in the pantry for safekeeping so you can enjoy it later. One day, you get the munchies and decide to finally revel in the chocolate-chip delight when you notice something terrible: it’s been bitten off.

You gobble the cookie whole — or at least what’s left of it. It is still delicious, but you can’t help feeling bitter at the fact that you could have had more of the cookie had you decided to eat it when you first put your hands on it, right then and there. You also feel angry at the unruly perpetrator. Yeah, you know who it was — the inflation monster strikes again!

What is inflation

In any free-market economy, prices for goods and services are never fixed for a long time. Some prices rise while others fall, depending on the influence of various market forces along with monetary and fiscal policies. However, whenever one speaks of an increase in prices for a broad range of goods and services, not just individual items, this is called inflation.

Not just any goods or services — inflation typically refers to the rise in prices for goods and services that are regarded as essential or in common use. These include food, housing, clothing, public transit, consumer staples, electronics, etc. Inflation is always relative to previous prices, which is why it is measured in percentages.

For instance, an inflation rate of 5% per year means that if your grocery shopping and recurrent bills cost you $100 today, it would have cost you about only $95 a year ago. The same basket of shopping will cost you $105 in a year’s time. If inflation stays at 5% for ten years, this same shopping will cost you $163.

When prices move in reverse (decrease), economists refer to this phenomenon as ‘deflation’.

So, inflation is a time when the buying power of money in terms of goods and services is reduced, while deflation is a time when the buying power of money in terms of goods and services increases.

What are the effects of inflation

Inflation causes prices to rise, affecting purchasing power. During inflation, the same amount of money that bought you goods and services a year ago, now buys less of them. In other words, inflation chips away at your purchasing power.

In fact, when inflation is extreme — a phenomenon called ‘hyperinflation’ where the monthly inflation rate exceeds 50% — money that used to buy you something is now worthless. In some cases, that wad of cash may be worth less than the paper it is printed on.

Look no further than Venezuela for a prime example of how inflation can ruin a country’s economy and the livelihoods of its people. In 2018, Venezuela experienced an inflation of 130,060%, which is equivalent to saying 130,060 US dollars would offer the same purchasing power as one US dollar after only a year.

The situation is so ridiculous in Venezuela, that stores don’t even label prices. What’s the use when prices can change by the hour?

To make matters worse, Venezuela has been experiencing hyperinflation for years, reflecting the country’s poor economy that has shrunk by half in a span of five years.

However, inflation in most countries isn’t nearly that bad. In the United States, the annual inflation rate in the last two decades has typically been around 2% to 4%.

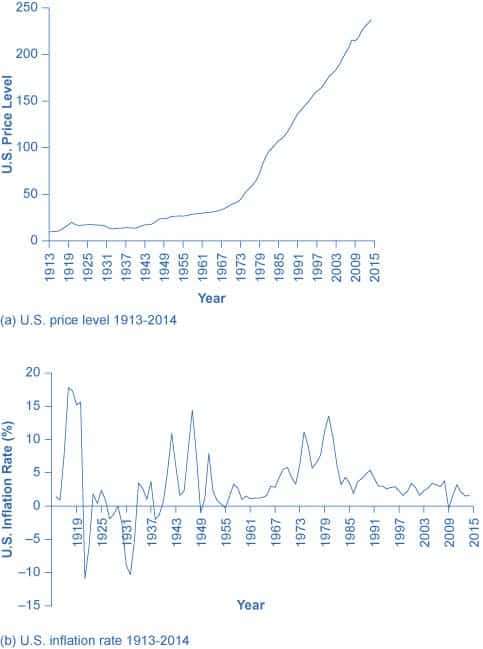

Of course, that’s not to say that the U.S. hasn’t seen its fair share of bloating inflation. In this modern history, the country has seen its highest inflation rates during World Wars I and II, as well as more relatively recently in the 1970s.

In response to double-digit inflation from the 1970s, which didn’t end until the early 1980s, the central bank raised interest rates to 20%, leaving many Americans priced out of new cars and homes.

You can see how inflation rates evolved in the United States in the two diagrams below, starting from 1913 until 2014. Diagram A shows the level of prices in the Consumer Price Index, where ‘100’ is defined as the average level of prices that existed from 1982 to 1984. Diagram B shows the annual percentage changes in the CPI over time, which corresponds with the inflation rate.

What causes inflation

The price for any goods or services in a free market is heavily dependent on supply and demand — and money is no different. When the central bank prints more money, each dollar bill tends to become less valuable.

However, this doesn’t necessarily mean that printing more money will drive prices up. There’s also a demand side, so if there are more goods and services offered on the market, there will be more demand for cash. It is this dance between demand and supply for cash that drives prices up or down, creating inflation or deflation.

This is why some economists are in favor of small annual inflation rates, arguing that it drives consumer spending, thus fueling the economy. In fact, the Federal Reserve is actually targeting certain inflation rates with its monetary policy, rather than making efforts to reduce it.

On the flip side, inflation discourages savings, which can motivate individuals to engage in riskier investments to increase or even maintain their wealth. For this reason, some economists claim that inflation benefits only a minority of businesses and individuals at the expense of the majority.

The types of inflation

Inflation means the same thing anywhere: prices go up. However, not all inflation is triggered in the same way, which is why economists have identified several types of inflation.

Demand-pull inflation occurs when consumers demand more goods and services than there are available. Imagine you run a factory that just released the sleekest electric vehicle on the market. People are throwing money at you, but despite your staff’s best effort, with production ramped to the max, you can’t meet demand. Since demand is huge relative to supply, the price for the product goes up accordingly.

Cost-push inflation is also a result of more demand than supply, with the key difference being that supply is affected by production costs. In line with our previous example, imagine that China — who is the world’s most important supplier of rare earth minerals — suddenly rose prices on their end. Better yet, imagine that the U.S. government slaps an extra tariff on imports of these resources from China. In any case, the result is the same, the production cost rises, and prices must go up to preserve the bottom line.

The two examples are the most common types of inflation. Less frequent types of inflation include hyperinflation (out of control inflation), pricing power inflation (when a company that has a monopoly raises prices simply because they can and consumers don’t have an alternative), sectoral inflation (rising prices confined to a single industry), and stagflation (rising inflation and unemployment despite slow economic growth).

Is inflation inherently bad? Not always. In fact, a bit of inflation is actually welcome sometimes

The very idea of money losing its value over time seems awful. Who on Earth wants their money to be worth less? But there are instances when inflation can help the economy, thereby boosting purchasing power.

When there are more dollars in circulation, people spend more, driving demand for goods and services. More demand tends to (but certainly not always) boost production in order to meet the additional demand.

According to famed British economist John Maynard Keynes, at least some inflation is required to stave off the Paradox of Thrift — the idea that consumers will hold off purchases to wait for a better deal, which reduces aggregate demand, leading to less production, unemployment, and a generally poor economy.

Inflation is also great for debtors, who can repay loans with money that is less valuable than at the time of borrowing. Obviously, this encourages peoples and businesses to borrow or lend, which again increases spending.

This last point is also why many governments are very fond of ‘good’ inflation. The world’s number one debtor is the United States government, its debt amounting to $25.7 trillion as of May 27, 2020. Having some inflation eases the burden of this massive debt.

In other words, high inflation is very bad, but so is low inflation. For the U.S. Federal Reserve, a 2% inflation rate hits the sweet spot.

This shows that inflation is not necessarily a catastrophe (unless you live in Venezuela). Instead, inflation is actually part of modern monetary policy and is actively pursued by most states in the developed world.

How inflation is measured

In the U.S., the rate of inflation is tracked using the consumer price index. The index is the average price of a basket of goods and services that are in common demand. Its year-to-year change corresponds to the annual inflation rate.

This index, however, is an average value. So, although the inflation rate might be 2%, some goods and services might have actually risen above or fallen below that value.

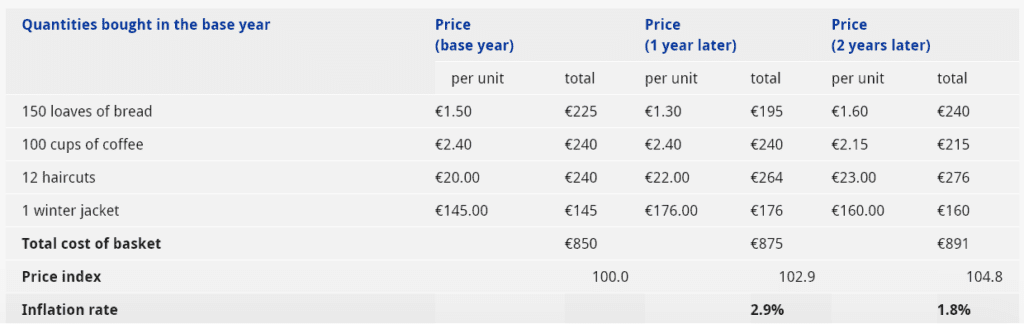

Below is an example of an annual ‘basket’ of goods and services consumed by households. The difference in pricing over the years can tell us the rate of inflation.

Bottom line: inflation is defined as the rate of change in pricing for a broad range of goods and services in demand by households. A little inflation is healthy for the economy, but too much of it can slow down the economy and increase unemployment. This is why monetary policy (printing money, setting interest rates) is a very delicate balancing game.

As long as your cookie also keeps growing, the inflation monster isn’t that scary at all.