In a pioneering display of cognitive dissonance, EPA chief Scott Pruitt said on Monday that he would to do away with subsidies for renewable energy and let them “stand on their own and compete against” other sources of energy, such as fossil — the latter being heavily subsidized, and has been so for decades.

Image credits me / ZMEScience, free to use with attribution.

Another week, another Pruittism. This Monday, the Environmental Protection Agency Administrator said that he believes federal tax credits for wind and solar power should be eliminated in the interest of fair play on the energy market.

“I would do away with these incentives that we give to wind and solar,” he told attendees at a Kentucky Farm Bureau event.

“I’d let them stand on their own and compete against coal and natural gas and other sources, and let utilities make real-time market decisions on those types of things as opposed to being propped up by tax incentives and other types of credits that occur, both in the federal level and state level,” he further explained.

Now, I like hypocrisy just as much as the next guy (spoiler alert: I don’t) but Mr. Pruitt definitely went to previously un-dredged lows with that announcement. To see why, let’s take a look at what subsidies are and how they play out across the energy sector.

[panel style=”panel-info” title=”Subsidy, according to the Merriam-Webster dictionary” footer=””]

A grant or gift of money: such as:

a) a sum of money formerly granted by the British Parliament to the crown and raised by special taxation

b) money granted by one state to another

c) a grant by a government to a private person or company to assist an enterprise deemed advantageous to the public.

[/panel]

We’re interested in the latter meaning of the word. Let’s take a look at the subsidies Mr. Pruitt would do away with:

- Wind power currently enjoys a tax credit of about 2.3 cents per kWh produced, and the measure starts phasing out this year and will expire completely in 2020.

- Solar energy investments get tax credits equal to 30% of their sum to encourage companies to invest in the sector. These credits will expire completely by 2022.

These incentives enjoy wide support among environmentalists and Democrats, while direct competitors of renewable in the energy market obviously oppose them, as do some Republicans. They’ve been touted again and again as the sole reason why renewable energy has seen such rapid growth in recent years, and the fossil fuel industry has been endlessly complaining they’re an unfair advantage.

Now let’s take a look at the subsidies oil, gas, and coal receive, as quantified by researchers at Oil Change International (full report at the bottom of the article). The sums in brackets are the estimated costs per year of these subsidies. Find a comfy seat, ’cause this is going to take a while.

The monetary black hole that is fossil fuel subsidies

Exploration and production related:

- Intangible drilling oil & gas deduction ($2.3 billion): Independent producers can fully deduct costs that aren’t directly related to the final operation of wells (such as labor, surveying, ground clearing, including development costs). Integrated companies can deduct 70% up front and the rest of 30% over five years.

- Excess of percentage over cost depletion ($1.5 billion): Independent fossil fuel producers can deduct a percentage of their gross income from production, reflecting reservoir depreciation.

Non-production related:

- Master Limited Partnerships tax exemption ($1.6 billion): A special corporate form that is exempt from corporate income taxes and publicly-traded on stock markets, primarily available to natural resource firms, the majority of which are fossil fuel companies.

- Last-in, first-out (LIFO) accounting ($1.7 billion): Allows oil companies to assume for accounting purposes that they sell the inventory most recently acquired or manufactured first. When inventory is experiencing increasing prices, LIFO assigns the most recent prices to cost of goods sold and oldest prices to remaining inventory, hence resulting in the highest amount of cost of goods sold and lowest taxable income for the company. It gets even better! LIFO-like measures are prohibited under international financial reporting standards.

Fire-sale on federal lands:

Author’s note: these methods hand over energy resources from public lands and federally-controlled waters to the fossil fuel industry at extremely low relative prices.

- Lost royalties from onshore and offshore drilling ($1.2 billion): outdated royalty exemptions, rate setting, and procedures for assessing oil and gas production on federal lands shortchange taxpayers by more than a billion dollars each year. If the federal government were to charge a 20% royalty rate for onshore drilling, the lowest rate charged by the state of Texas, taxpayers would benefit from an additional $3 billion in revenues.

- Low-cost leasing of coal-production in the Powder River Basin ($963 million): allows coal companies to lease federal land at low costs in the Powder River Basin (PRB), a mostly federally-owned coal-producing region in Wyoming and Montana that accounts for 40 percent of U.S. coal production (and 85 percent of coal production from federal lands). By exempting from ‘major coal producing region’ status, the federal government did away with requirements to plan and monitor coal production according to a systematic management process, making for significantly lenient lease rates in the PRB.

From now on I’ll just give a few examples in each category, and I’ll keep them short because most of you are probably dozing off by now.

Coal Bailouts:

Author’s note: as coal companies become insolvent, taxpayer dollars cover their obligations to communities and workers.

- Inadequate industry fees recouped to cover the Abandoned Mine Land Grant Fund ($400 million).

- Inadequate industry support to cover worker health impacts ($330 million).

Pollution subsidies:

- Deduction for oil spill penalty costs ($334 million).

- Tar sands exemption from payments into the Oil Spill Liability Trust Fund ($47 million).

Subsidies that lock in fossil fuel dependence:

- Enhanced oil recovery credit ($235 million in 2017, could cost $8.8 billion over the next decade according to The Office of Management and Budget).

- CO2 sequestration credit ($95 million).

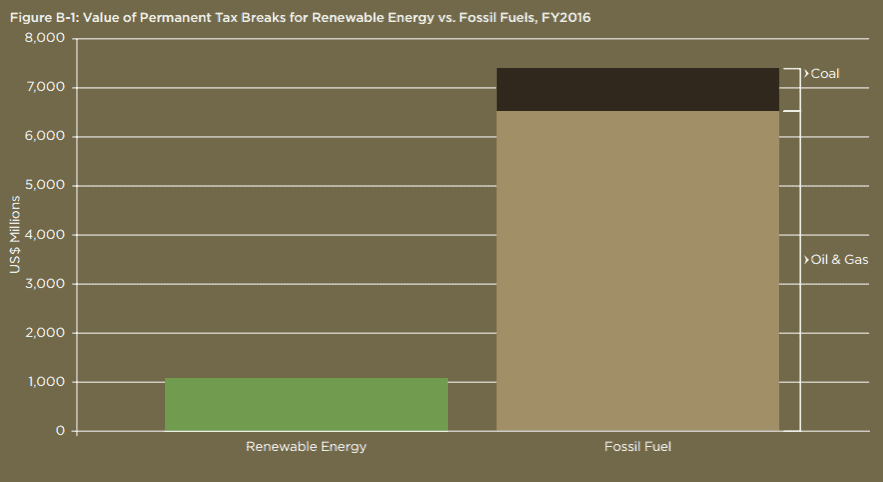

Gets hard to follow, so here it is in chart form for 2016:

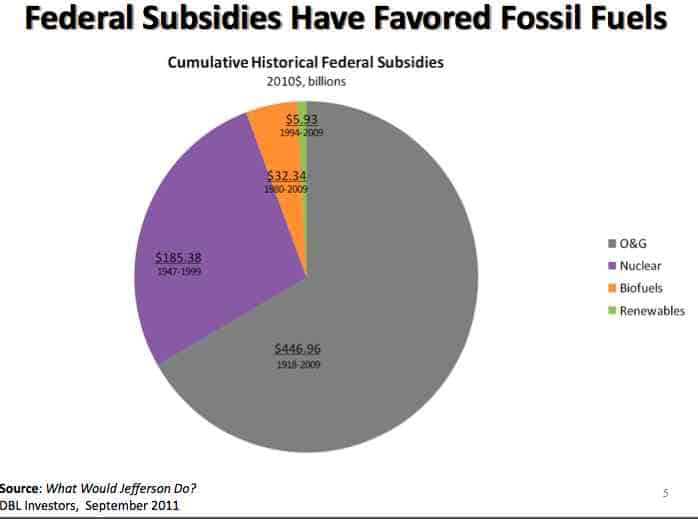

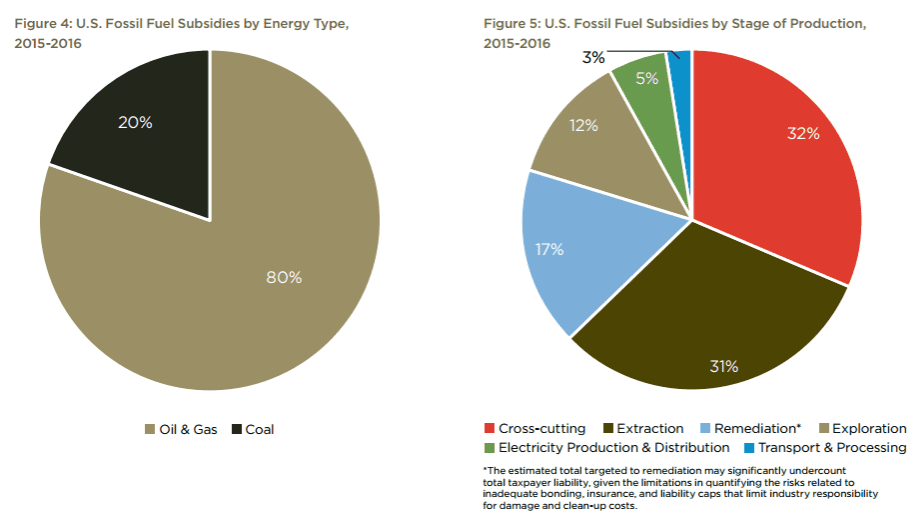

Add everything up and you get $14.7 billion in federal subsidies and $5.8 billion in state-level incentives, for a total of $20.5 billion annually in corporate welfare. One-fifth of that goes to coal, the rest to oil and gas. Another factor at play here is continuity and length of these subsidizing schemes.

Image via CleanTechnica.

“There is a myth around subsidies, but there is no such thing as an unsubsidised unit of energy,” Hochschild told RenewEconomy after his presentation, and CleanTechnica later picking up on the quote here. “The fossil fuel industry hates to talk about that,” he added.

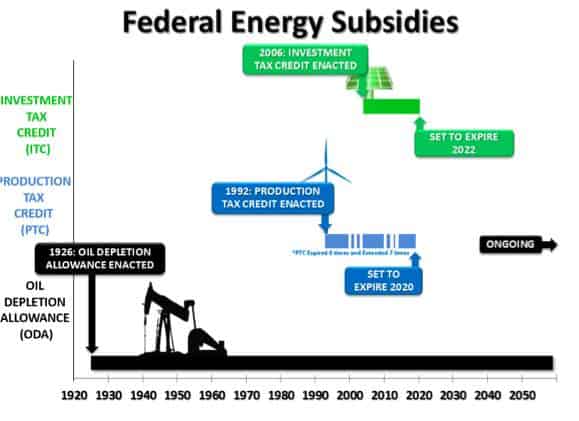

He explained that oil depletion allowances have been in place since 1926 and would continue, despite the fact that oil is “one of the most profitable industries in the world.” Insurance costs for nuclear plants, “without which there would be no nuclear plants,” are also a subsidy, CleanTechnica goes on to write. Drilling or fracking, which have been made exempt from compliance with the safe drinking water act, also serve as a subsidy by allowing natural gas companies to cut costs.

US wind and solar industries were stifled with repeated changes to their federal support mechanisms. The tax credits have been changed seven times in a decade, according to Hochschild.

“How can you plan a wind turbine factory or project in those types of conditions?” he asked.

A sliver of a crumb

Everything I’ve listed above is only part of the direct subsidies fossil fuel companies receive in the US, because the OCI only looked at direct production subsidies. OCI notes that the estimates of state-level subsidies are probably low, since many states don’t report the costs of tax expenditures (i.e., tax breaks and credits to industry), so data is difficult to come by.

Add to the above roughly $14.5 billion in consumption subsidies (things like Low Income Home Energy Assistance Program, which helps residents pay for heating bills,) $2.1 billion in subsidies for overseas fossil fuel projects, and probably the single greatest offender, indirect subsidies. This latter category involves things like the money the US military spends to protect oil shipping routes, or the unpaid costs of health and climate impacts from burning fossil fuels, which are naturally really hard to quantify precisely but navigate in the region of hundreds of billions of dollars.

It’s not happening in the US alone. According to the International Energy Agency, global subsidies for fossil fuels outweigh those for renewable energy more than 10-fold — CleanTechnica estimates it’s more than 13-fold if you don’t count biofuels. Vox reported that the International Monetary Fund estimates the world spends $500 billion in direct subsidies for fossil energy, a figure that increases to about $5.3 trillion a year after indirect spending (including environmental damages) are factored in.

But only Mr. Pruitt has the audacity to claim subsidies unfairly favor renewables, and they should be scrapped. It’s both hilarious and infuriating when the chief of the EPA says that, considering that the US’ subsidy policy on renewables is “hey we’ll help cover a bit of the cost of each unit of energy a wind turbine produces, and any company that invests in building solar energy will get just shy of 1/3 of that investment as a tax reduction. For the next 3-5 years.” Then it turns around and shells some $30 billion to fossil fuel companies every year.

Why? Well, as OCI concludes:

“In the 2015-2016 election cycle, oil, gas, and coal companies spent $354 million in campaign contributions and lobbying and received $29.4 billion in federal subsidies in total over those same years — an 8,200% return on investment.”

Every penny of that is paid from your pocket. Every year, your taxes pay for a company’s search for new deposits and the means to exploit them, its tax breaks, covers accounting artifices that are banned under international financing standards, forfeiture of royalties, dirt-cheap leasing, and finally they cover the costs when that company pollutes your air and water or simply fracks up big time and spills something or goes insolvent. Every year, some starting as far back as the 1900s.

All of it so that a fossil fuel company can keep making money, despite the fact that renewables can take up the job for less spending, fewer health impacts, less wealth concentration. And with 100% less global warming cover-up shenanigans.

So tell me again about how energy companies need to “stand on their own and compete” Pruitt, you brass-necked hypocrite.

OCI’s full report is available here. For a more comprehensive list of the subsidy schemes energy companies enjoy, as well as more details for the ones I’ve listed here, you can use the Green Scissors database.