AI promised to take the world by storm, and it’s starting to do so.

In 1950, five years before the term ‘Artificial Intelligence’ (AI) was even coined, Alan Turing was already wondering if machines can think. As far as we can tell 70 years later, machines can’t yet think for themselves — they rely on the data we feed them.

However, if we do feed them good quality data, and we train them properly, AIs can already do wonderous things. Take Google’s AlphaZero algorithm, for instance. It was only told the rules of chess and taught to play against itself. In almost no time, it surpassed the sum of human chess knowledge and started coming up with its own strategies. But AIs have much more concrete applications than chess. Google itself explained that the AIs it develops are only a stepping stone to a more practical purpose: study folding proteins, a key process to designing newer, more effective drugs.

AIs have already entered healthcare, detecting diseases and analyzing lab data. It’s still a work in progress, but for a technology which was virtually non-existent 10 years ago, it’s a remarkable leap.

Companies are already using AI to cut their costs. Google stands out once again, deploying an AI that reduces its server cooling costs by 40%. As the technology matures and becomes more accessible, more and more companies are using it — and they’re using it to make money.

AI meets $$$

With all this potential, it was only a matter of time before AI in the financial sector becomes a reality. Financial companies use and generate a lot of data, and it’s exactly the type of data you’d expect machine learning to be efficient in. Kane Georgiou, owner of The Money Pig is the first to agree.

“As a financial comparison site, we rely heavily on technology. With AI, we can take things one step further. For example, we are currently developing a tool to help consumers monitor their budget, make suggestions on their spending habits and ultimately save them money.”

A recent study found that already, AI is changing how financial institutions gain insights from data. Furthermore, companies are using this edge to look at new business models and develop new angles for profit generation.

Out of the 151 surveyed financial institutions, 64% expect to become mass adopters of AI within two years — although only 16% are already adopters. AI is no longer a future prospect, it’s something that’s considered in the short run: 77% of respondents anticipate AI to have a high or very high importance to their business. While their perception isn’t necessarily an indication of how things will turn out, it shows how much companies will focus on AI.

For financial companies, in particular, risk management is extremely important. This is the field that currently has the highest implementation rate (56%), though it is closely followed by the generation of new revenue through AI products (52%). Firms expect the latter to become much more prevalent in the next two years — this is clearly highlighted by the fact that most fintech startups focus on AI products.

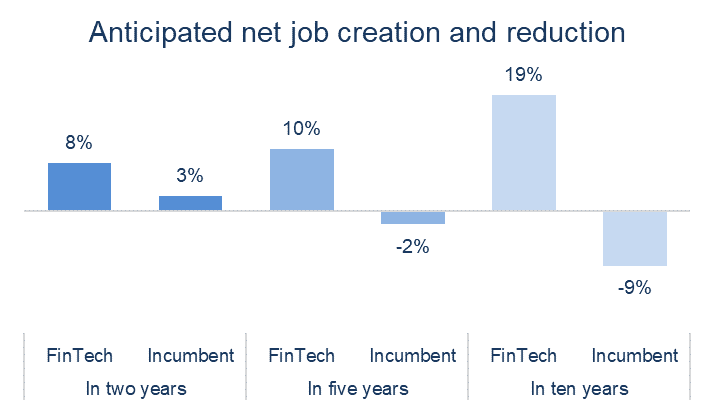

Surprisingly, this transition won’t destroy jobs in the financial sector — on the contrary, it’s expected to have an overall positive effect. While nearly 9% of incumbent financial services jobs are expected to be lost by 2030, FinTechs anticipate that AI will expand their workforce by 19% in the same time frame.

However, there are also serious impediments to AI implementation. Behind all the smoke and hype, there are many technical hurdles. For starters, data quality for training algorithms, as well as access to sufficient data in general is challenging. Then, since this is such a new field, qualified personnel is still lacking. The cost of both hardware and software is uncertain, and there is still plenty of market uncertainty.

AI implementation in the financial sector is, while exciting, not yet a done deal.

To make matters even worse, there are known problems with using AI in finances. Most notably, firms expect AI to create or exacerbate bias in credit analytics, which could affect millions of peoples’ livelihoods.

It’s also not clear if and how AI will be regulated — which could be a massive obstacle.

Yet, despite these challenges, the market seems very optimistic. Invesco’s Chief Technology Officer, Donie Lochan, believes that the incredible opportunities AI creates for financial services cannot be overstated. He concludes:

“The report highlights the amazing opportunity ahead of us in financial services for using artificial intelligence and machine learning to the benefit of our customers and our organizations. Technological advances such as leveraging intelligence to define investments for customers tied to their personalized goals, improving customer experience through the use of intelligent bots, additional alpha generation via insights from alternative datasets, and operational efficiencies through machine learning automation, will soon become the norm for our industry.”