Rivers of ink have been spilled on taxes. They are an important part of the very foundation on which our society is built, with former U.S. Supreme Court Justice Oliver Wendell Holmes Jr. proudly declaring, “I like to pay taxes. With them, I buy civilization.”

But taxes are, almost universally, hated — and it’s easy to understand why. You pay a significant part of your income to a rather abstract administration, and you don’t always get to see the fruits of your labor. You can’t exactly point to a tree or a sidewalk and say “my taxes built this”, and it can be pretty demoralizing to not know what your money is spent on. Plus, taxes cost a lot. Mark Twain once famously complained that ” The only difference between a tax man and a taxidermist is that the taxidermist leaves the skin.”

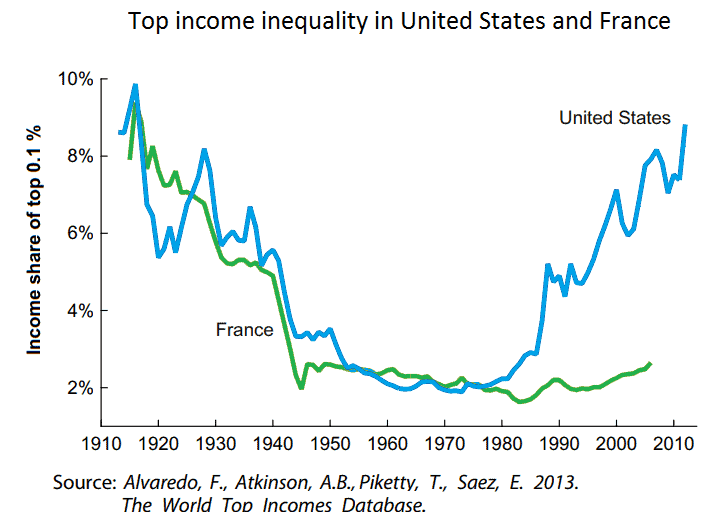

The real problem with taxes, aside from easily understandable inconveniences, is that they’re often unfair — and the simplest proof of that is rising income inequality.

Homo economicus

Income inequality is one of the most pressing economic problems of our times. As the old saying goes, the rich get richer, and an alarmingly high portion of the population gets left behind, often in poverty. In the US, 11.8% of the population (38.1 million people) live in poverty. Meanwhile, the world’s richest have gained $1.2 trillion in wealth in 2019 alone. Taxation is the main mechanism through which inequality can be addressed, but devising a tax system that works for everybody is not an easy task.

Tax too little and you’ll end up with rampant inequality. Tax too much and you’ll discourage people from working or seeking wealth. Finding a custom-tailored balance is not an easy task. Economists have long searched for ways to satisfy both needs, but the balance is difficult to achieve.

Economics is further complicated by human behavior. For centuries, economists have developed theories based on Homo economicus — the idea that humans are perfectly rational beings, taking rational decisions. That is, of course, not the case. It may often be a satisfactory approximation, but it is becoming increasingly apparent that Homo economicus will just not do in our modern times.

People’s economic behavior is complex, unpredictable, and it’s very hard to get data on this. Economists too have varying opinions on this. Place 10 economists in a room and ask them to come up with a taxation system, and you’ll end up with 11 solutions.

This is why Artificial Intelligence (AI) can help — or so a group of scientists believes.

The scientists, working at US technology company Salesforce, devised an artificial intelligence system charged with developing the ideal tax system.

Beating us at chess, Starcraft, and now, economics

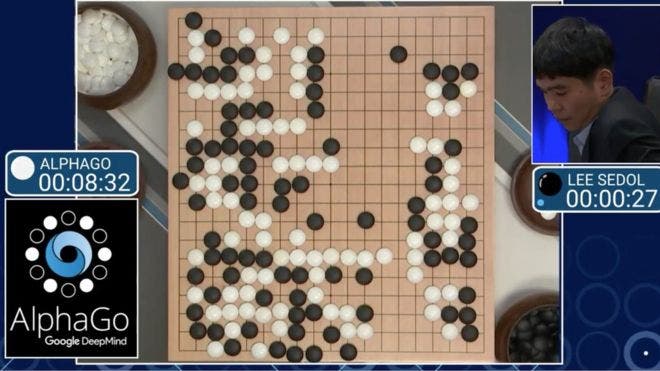

The new program, called AI Economist, uses the same technique behind AIs such as AlphaGo or AlphaZero. These algorithms are famous for defeating humans (and other algorithms) at chess, Go, and more recently, Starcraft.

Reinforced learning is a system of punishment and reward used in machine learning. You set a reward system for the program, and then, based on the decision it takes, it receives more or less reward. This incentivizes the algorithm to find the solutions that offer the most desirable outcomes

So far, AI Economist is still a pretty simplistic approximation. In it, four AI workers are each controlled by their own reinforcement learning models. They interact with a simplified 2D world which only includes basic resources such as wood or stone. The workers either gather resources, trade them (which can earn them money), or build houses. The AIs also have different skill levels, which incentivizes them to focus on different things. Lower-skilled workers do better if they focus on gathering resources, while higher-skilled ones fare better if they build houses.

At the end of a simulated year, they are all taxed by an AI policymaker, running its own algorithm. The policymaker’s goal is to boost the productivity and income of workers.

It’s a very simple model, but it can be repeated millions of times until the optimal behavior in the scenario is found. Then, as the general strategy is discovered, it can be scaled to more complex scenarios.

There is surprisingly much you can learn from only 4 AI workers. The fact that both workers and policymakers have their own incentive is key to mimicking a more dynamic situation where the workers and policymaker AI constantly adapt to each other. For instance, some workers learned to avoid tax by reducing their productivity to qualify for a lower tax bracket and then increasing it again. The policymaker AI had to adapt to this, and every iteration, the system would be optimized.

The simulation also showed that some strategies developed by workers only worked in some strategies adopted by the policymaker, so worker AIs also had to adapt to the policymaker.

AI tax policy

In the end, the tax policy developed by the AI Economist was an unusual hybrid.

Most taxation policies are either progressive (with high earners being taxed more) or regressive (with high earners being taxed less), but the AI implemented a bit of both. It applied the highest tax rates to the rich and the poor and the lowest to middle-income workers.

If that seems weird, well, it is. But it doesn’t necessarily mean it’s wrong. Reinforced-learning AI often comes with completely non-intuitive, almost non-human solutions. In the Go game between AlphaGo and world champion Lee Sedol, the AI made a move at one point that had all commentators thinking it was a software glitch. It was so counterintuitive and weird that no one could believe it was real — and it was the move that ended up winning the game. Similarly, AlphaZero has created completely new trends in chess, such as pushing the side pawns, which was traditionally considered to be a mistake.

Of course, this doesn’t mean that the AI Economist is necessarily right — but it’s exactly this type of out-of-the-box solution that economists were looking for.

Taxing both the rich and the poor and supporting the middle class is not something that most humans would be comfortable with, but this approach led to a smaller gap between the rich and the poor workers.

Then, researchers put this optimized approach to the test — with humans this time. They hired 100 human people through Amazon’s Mechanical Turk and asked them to play the role of workers in the simulation. They found that the policy encouraged people to behave in much the way the worker AIs did, hinting that the strategy could have a real influence in a real, human situation.

It’s still early days and it’s still far too soon to draw any conclusions. The number of interacting agents needs to be increased dramatically before we can talk about practical insights, as does the number of resources. But once all that is done, and the economic model is tweaked, the model could become instantly useful. Then, the model could be tweaked to mimic particular scenarios and situations and ran millions of times until optimal strategies are found.

Whether or not the approach will have practical insights remains to be seen. Even if it does, it will still need to convince economists, politicians, and voters — and that is a completely different ball game. Leading economists are already calling for a tax on carbon, for instance, and that is something that very few politicians are even willing to consider, let alone implement.