Ageing is increasingly affecting developed (and even developing) nations. As the demographics of countries continue to change, governments will find it harder and harder to

Earlier this month, China released its once-in-a-decade survey. At first glance, it wasn’t all that striking: the country’s population is still growing, though at a slower rate. But one part in particular alarmed Chinese officials: the working people/pensioners rate. China’s population is increasingly looking like that of a developed country, with fewer workers to support more retirees in the years to come. It’s not just the financial problem, but also the long-term care and healthcare that comes with this demographic shift.

Ageing is affecting many OECD countries, and governments have yet to discover the secret sauce to fighting this trend (or at least a clear way to compensate it). A new OECD report looked at what systems have in OECD and non-OECD countries for long-term care and health care, as well as the types of insurance products that are made available in these countries. The main focus was to see how national systems and the private market can work complementarily to ensure the long-term care of retirees.

“Many countries are or will struggle with how to reform their care system to bring these costs under control, while ensuring that those in need can access the necessary care of quality,” the report starts off.

The OECD defines long-term care as paid care for people in need of support in their day to day life — support that is not provided by a medical doctor. Long-term care can be financed through a mix of financing arrangements, including government spending, some form of social insurance, as well as voluntary private insurance or private funds. Oftentimes, however, it is provided by communities and families, which was not considered for the purpose of the report.

To launch the project, the OECD circulated a questionnaire to delegates of countries about the management of long-term care. The questionnaire showed that already, many insurance companies are already stepping to provide long-term care. Most countries that responded (18 of 21 respondents) named the ageing population as one of the main factors impacting long-term care. Across the board, the increase share of elderly population brings challenges that governments are struggling to adapt to, and companies are starting to move in to fill the gap.

Many countries are already working on reforms to change social security and/or the insurance sector with regards to long-term care. The Czech Republic, for instance, is working on streamlining the provision of services across the welfare and health system. Meanwhile, Japan wants to publish a new blueprint on social security, while Korea is introducing a community care program for the elderly to receive care at home from the local community. Countries like Israel, Lithuania, and the UK are also working on major reforms.

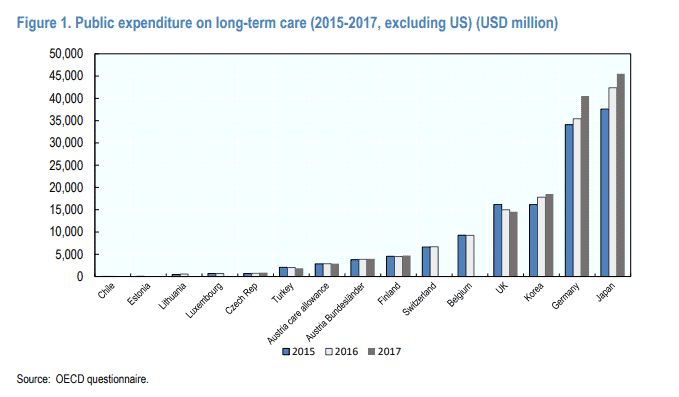

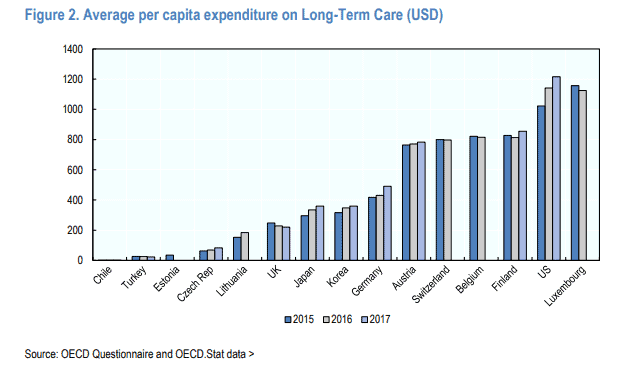

The countries were also asked if estimates have been made on the future expected expenditure on long term care. Most countries have some sort of projection about future expenditure based on different scenarios, but how realistic those scenarios are is still unclear.disclosed the estimates on future expected expenditure on LTC (some relying on EU reports) based on different scenarios.

The method of covering for this care is typically direct payments from insurers, but other methods like fee-for-service are also common. In some countries, out-of-pocket payments are required for long-term care, even if an insurer exists. For instance, in Japan, individual financial status is taken into account when deciding how much the patient would need to pay, while in Korea, once an income threshold is reached, 1% of a person’s assets are used for payment calculations.

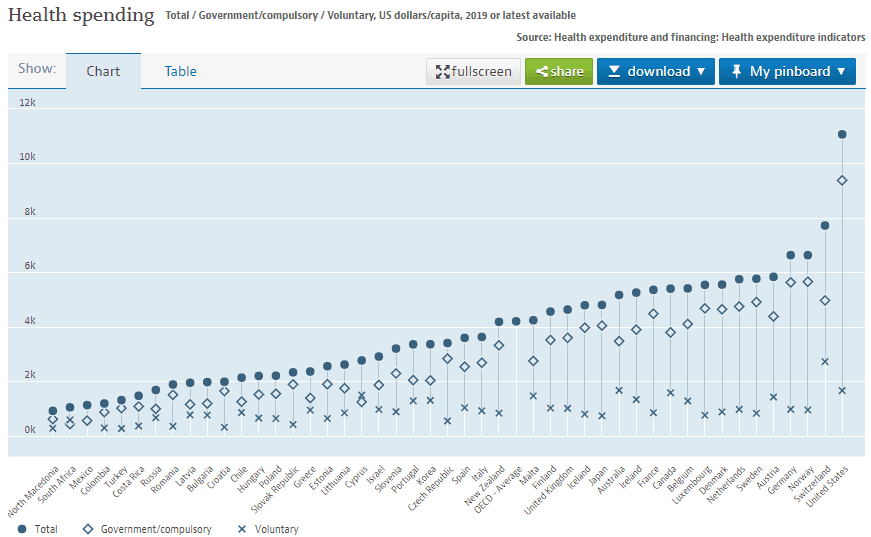

All countries in the report have reported considering the financial sustainability of the healthcare system. Long-term care and its sustainability is a major topic everywhere you look, with countries increasingly looking at private insurers to compensate for government shortcomings. But too great of a reliance on these insurers can cause more problems than it solves, as is the case in the US, which spends far more than other countries for equivalent services.

Ultimately, it seems that most if not all developed countries have some sort of plan to deal with the ageing population and provide care to their ageing population. It seems that all these plans include some level of cooperation between government action and private insurers, with varying degrees of coverage. However, plans on paper are one thing — whether or not they will hold up is another.

Still, countries have one ace up their sleeve: per capita productivity is increasing steadily. With the aid of robots, computers, and other non-human aids, people are producing more and more value. So while the number of workers is decreasing relative to retirees, those few workers can produce more.

But it’s a tricky race. Just one wrong step could lead to a long-term uphill battle, where countries find it impossible to cover the necessary care for their ageing population. The future is full of challenges — hopefully, we’ll be up to them.